All Categories

Featured

In 2020, an approximated 13.6 million U.S. households are approved financiers. These homes control huge wealth, approximated at over $73 trillion, which stands for over 76% of all exclusive wide range in the U.S. These investors take part in financial investment possibilities generally not available to non-accredited financiers, such as investments in personal firms and offerings by particular hedge funds, exclusive equity funds, and equity capital funds, which enable them to grow their wealth.

Keep reading for details concerning the latest certified investor modifications. Resources is the fuel that runs the economic engine of any nation. Financial institutions typically money the bulk, yet rarely all, of the funding needed of any purchase. After that there are situations like start-ups, where banks don't give any type of financing whatsoever, as they are unproven and thought about dangerous, however the requirement for capital continues to be.

There are mostly two rules that enable companies of safeties to supply limitless amounts of safeties to investors. sec rule 501 accredited investor. Among them is Guideline 506(b) of Guideline D, which allows a provider to offer protections to unrestricted accredited capitalists and as much as 35 Advanced Investors only if the offering is NOT made with general solicitation and general advertising

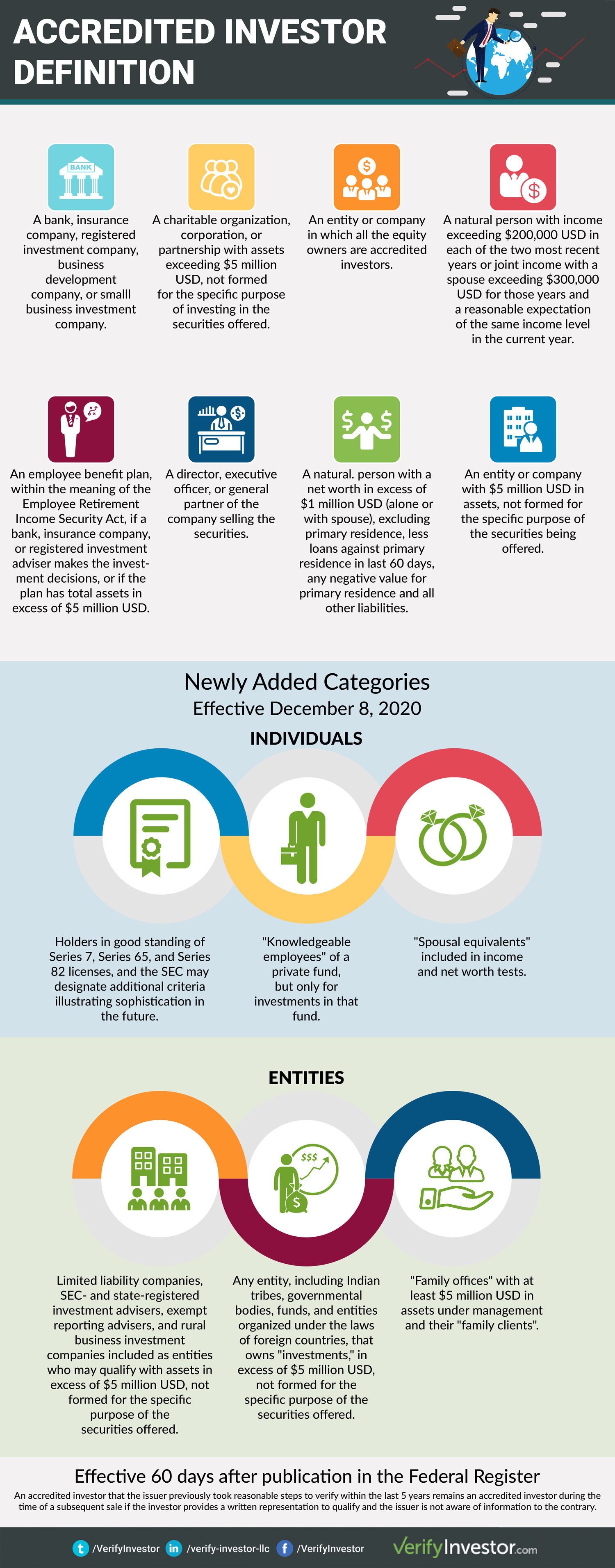

The recently embraced changes for the very first time accredit private financiers based on economic class requirements. A number of other changes made to Policy 215 and Regulation 114 A make clear and expand the listing of entity types that can qualify as a recognized capitalist. Below are a couple of highlights. The modifications to the accredited capitalist definition in Policy 501(a): consist of as recognized investors any depend on, with total assets greater than $5 million, not created specifically to buy the subject safeties, whose purchase is directed by an advanced person, or include as certified investors any type of entity in which all the equity owners are approved financiers.

And currently that you know what it means, see 4 Real Estate Advertising techniques to attract accredited investors. Internet Site DQYDJ ArticleInvestor.govSEC Suggested changes to definition of Accredited CapitalistSEC improves the Accredited Capitalist Definition. Under the government protections regulations, a firm may not use or sell safeties to investors without enrollment with the SEC. There are a number of registration exceptions that eventually expand the cosmos of prospective capitalists. Several exemptions call for that the financial investment offering be made just to individuals who are certified financiers.

In addition, recognized investors commonly obtain much more positive terms and higher possible returns than what is offered to the public. This is because personal positionings and hedge funds are not called for to abide by the exact same governing needs as public offerings, enabling more flexibility in terms of investment approaches and possible returns.

Regulation D Accredited Investor Requirements

One factor these security offerings are limited to accredited capitalists is to make sure that all getting involved capitalists are financially advanced and able to fend for themselves or sustain the danger of loss, thus providing unnecessary the protections that come from a registered offering.

The net worth examination is reasonably simple. Either you have a million bucks, or you don't. On the earnings examination, the individual has to satisfy the thresholds for the 3 years regularly either alone or with a spouse, and can not, for instance, please one year based on private earnings and the following two years based on joint income with a partner.

Latest Posts

Delinquent Property Tax Auctions Near Me

Back Taxes Home For Sale

How Does Investing In Tax Liens Work