All Categories

Featured

Table of Contents

They seem to have some of the ideal deal circulation of all the sites meaning that there are an excellent variety of chances to select from at any kind of provided time. They likewise use several sorts of deals including their very own fund. RealtyMogul is one of the earliest players in the area.

They market themselves as the choice to investing in stocks and bonds. They give access to private market genuine estate via their eREITs and eFunds.

How does Exclusive Real Estate Deals For Accredited Investors work for high-net-worth individuals?

Real estate crowdfunding has really shaken up the genuine estate investment landscape by drastically raising the degree of access to bargains for the typical investor. It assisted me dip my toes into the genuine estate investing globe and has now come to be a considerable part of my personal portfolio.

Clearly, it's not without danger, and if/when there's ever a decline in the real estate market, you will likely see some even more publicized losses. The much better the system, their monitoring, and their vetting process is, the much better off you'll be. No person platform will certainly have an excellent batting portion, there will be some offers that underperform.

It's likewise extremely crucial for you to carry out the basic due diligence too. One way is by joining our program Easy Genuine Estate Academy when it's open. Or else, there are several excellent resources around, you just need to browse and collect a bit. Please bear in mind that you have to be an recognized financier to buy a good variety of these sites.

Anybody else have some faves that I didn't state below? Exactly how's your experience been with some of these websites? [/sc.

In this guide, we've checked out the following: What a certified investor isTop financial investment opportunities for approved investorsHow to come to be a recognized investorIf you desire to discover even more regarding the investment opportunities open to this group of investors, reviewed on. The SEC normally calls for "" Securities not registered with the SEC generally can not be sold to the public.

They are enabled this exclusive access once they meet a minimum of one requirement relevant to their income, possession size, net worth, expert experience, or governance standing. Being an approved capitalist has numerous benefits, consisting of a wide choice of exciting financial investment options for portfolio diversification. You can buy anything, whether supplies, bonds, assets, or property, offered you have the risk resistance to manage it and the cash to make the needed dedication.

What should I know before investing in Accredited Investor Real Estate Investment Groups?

One significant benefit of being a certified investor is having a monetary benefit over numerous others. Certified financiers have accessibility to investment openings and opportunities that those with much less riches don't.

Below are eight opportunities worth considering: Investor are financiers that give funding or technical and managerial competence for startups and local business with high development possibility. They usually do this in exchange for a risk in the firm. As these firms expand and increase in worth, approved financiers can make also bigger returns on their earlier financial investments typically proportional to their ownership risks and the quantity invested.

Endeavor capital investing is frequently a great area to start for investors looking for lasting development chances. As with most alternate investment alternatives, you might have to sacrifice high risks for possibly higher returns.

The performance spreads of financial backing funds are amongst the widest of any type of alternative asset class, with some managers generating much less than 0%. This is why supervisor option is the vital to effective VC investing. If you're taking into consideration VCs, you want to select your investment car thoroughly and make them just a little part of your portfolio.

Accredited capitalists usually spend in these high-risk financial investment lorries to exceed the market or generate greater returns. Only the most affluent financiers commonly invest in hedge funds due to their high minimum financial investment or web well worth demands.

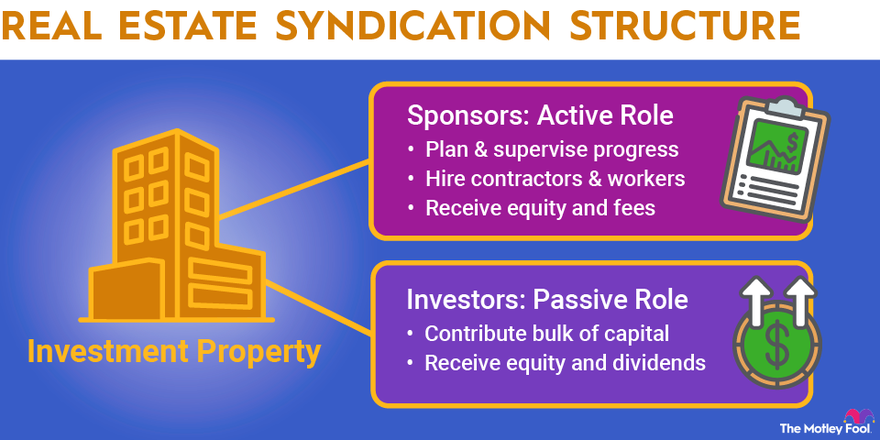

The area is large, and there are several possibilities to enter it (Real Estate Investing for Accredited Investors). Realty syndication, specifically multifamily, is one method approved capitalists have joined property. A few other options are spending via crowdsourced property platforms or investing via personal equity or hedge funds concentrating on realty

What are the top Private Real Estate Deals For Accredited Investors providers for accredited investors?

Is it worth becoming certified as an approved capitalist? It depends on the kinds of financial investments you're interested in, the current health and wellness of your net well worth, your danger resistance, and several other variables that just you can address. Let's state you're a professional with some quantity of resources that you 'd like to invest.

Specific capitalists can now purchase items of commercial real estate jobs around the country that were as soon as restricted to organizations and ultra-high internet worth individuals - Commercial Real Estate for Accredited Investors.

Who offers the best Accredited Investor Real Estate Income Opportunities opportunities?

To come up with a $300,000 downpayment on an average valued $1.5 million home is daunting. Rather, investors must consider real estate crowdfunding as a way to acquire direct exposure to real estate. Property crowdfunding has actually ended up being one of the most prominent investing devices considering that the JOBS Act was passed in 2012.

Unlike P2P loaning, there's in fact collateral with realty crowdfunding. This is why I'm a lot a lot more favorable on actual estate crowdfunding than P2P loaning - Passive Real Estate Income for Accredited Investors. The debtors can't just runaway with your money and disappear because there's an asset. One of the troubles with many of the websites is that you require to be an recognized investor to get involved.

Latest Posts

Delinquent Property Tax Auctions Near Me

Back Taxes Home For Sale

How Does Investing In Tax Liens Work